Immigration Business Accountant

Applying for Business Visa in South Africa can be both time-consuming and complex. Amendments to the Immigration Act No.13 of 2002 make it possible for an Immigration Engagements Accountant to issue certificates for Business Visa purposes. Whereas before only registered CA(SA) could perform this function. Xpatweb has an in-house Immigration Engagements Accountant complementing our bespoke Business Visa service, with no need for a CA(SA), thus ensuring a quick and efficient turnaround time with highly competitive pricing.

Business Accountants in Practice (SA) registered with SAIBA are officially allowed to issue certificate of factual findings report, as required by Regulation 14 (1) (a) and (2) (b) of the Immigration Regulations (as amended) under the Immigration Act, No. 13 of 2002.

SAIBA is one of the three professional bodies, whose members may perform an agreed-upon procedure engagements on the applications of Business Visas. SAIBA offers Practice Licence in Immigration Engagements certificate to all practising members (BAP (SA) of SAIBA and who are in good standing.

Engagement to perform agreed-upon procedure for Business Visa Application

International Standards of Quality Control (ISQC1)

The accountant must comply with the International Standards of Quality Control (ISQC1) as issued by the International Auditing and Accounting Standards Board (IAASB).

International Standard on Related Services 4400 (ISRS 4400)

The accountant must conduct an agreed-upon procedures engagement in accordance with ISRS 4400 and the terms of the engagement.

Objective of an agreed-upon procedure engagement

The objective of an agreed-upon procedures engagement is for the accountant to perform procedures of an audit nature, to which the accountant, the respective person, or entity, and any relevant third parties have agreed

The accountant does not express assurance in the report of the factual findings of an agreed-upon procedures. The users of the report draw their own conclusions, based on the procedures and findings reported by the accountant.

The report is restricted only to the parties, who have agreed to the procedures to be performed, as unrelated users may misinterpret the factual findings

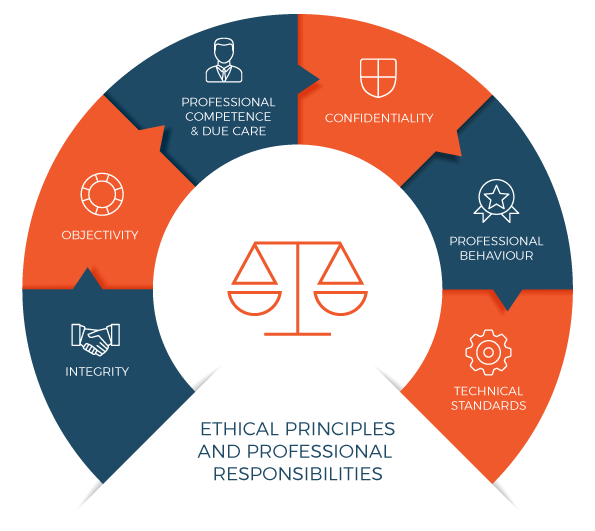

General principles of an agreed-upon procedure engagement

Supplimentary Legal Services for Foreign Investors

Due Diligence

Review of Contracts

Deeds Searches

Supplier Review

Compliance Review

Tax Structuring

Group Company Tax Efficiency

Funds Flow Structuring

Opinion Drafting

Entity/Trust Creation

Commercial

Tax Cognisant Drafting

Franchise Agreement

Shardeholders Agreement

Dual Employment Agreement

VAT

VAT Planning

VAT Disputes

Opinions

Rulings